The Challenge

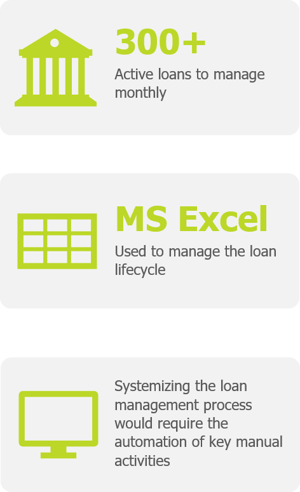

As part of the firm’s employee benefit programs, loans are made available to employees. Microsoft Excel was used to manage the loan lifecycle including outstanding principal amounts, monthly finance charges and employee contributions.

As part of the firm’s employee benefit programs, loans are made available to employees. Microsoft Excel was used to manage the loan lifecycle including outstanding principal amounts, monthly finance charges and employee contributions.

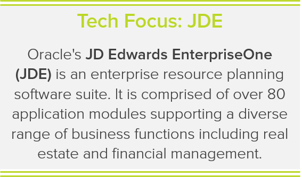

Required transactions were then manually posted to the general ledger of JDE.

With upwards of 300 active loans, using Excel for loan management was time intensive and prone to manual error. Excel also limited the ability to control access to sensitive information, enforce calculation consistency and generate suitable reports. An ongoing manual reconciliation between Excel and JDE was also required, further increasing manual processing overheads.

Systemizing the loan management process was thus a high priority and JDE’s Accounts Receivable module was identified as a suitable platform, subject to it being possible to automate key activities in the envisaged process.

The capture of cash receipts was identified as a time intensive activity, well suited to automation.

A pilot project was undertaken to implement this activity using the Open Box Automation Engine.

The Solution

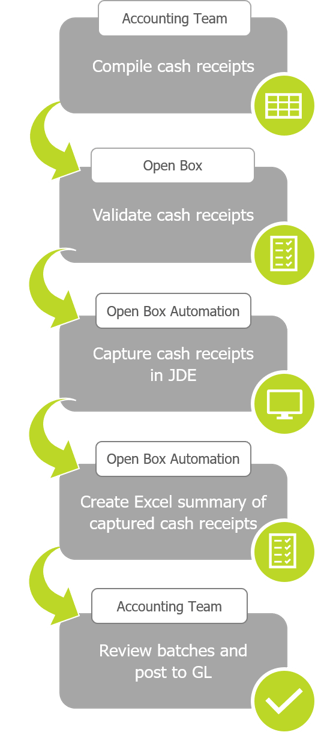

The Accounting Team compiles a list of cash receipts (each representing an employee’s contribution to their loan) in an Excel spreadsheet and emails it to the Open Box Automation Engine.

The Accounting Team compiles a list of cash receipts (each representing an employee’s contribution to their loan) in an Excel spreadsheet and emails it to the Open Box Automation Engine.

The Open Box Automation Engine performs an hourly retrieval of new cash receipts, then validates each for completeness.

JDE is accessed and each valid cash receipt is captured and applied against open invoices (each representing an employee’s loan finance charges and principal amount) in a defined order.

An Excel summary of the captured cash receipts, JDE batch numbers and any errors encountered are emailed to the Accounting Team for review.

To complete the process, the Accounting Team reviews the captured cash receipts in JDE and posts them to the general ledger.

The Result

-1.png?width=306&name=Hines%20V3%20(3)-1.png)

Feedback from the Accounting Team was positive, and the following benefits were also realized:

- Reduced the time and resources required to administer employee loans.

- Reduced errors by minimizing manual intervention.

- Provided the Accounting Team with additional capacity for more value-adding activities

- Provided a robust audit trail.

- Reduced the risk of fraud due to increased security measures.

The pilot project was deemed a success and JDE is now being used to manage loans with the assistance of the Open Box Automation Engine for the capture of cash receipts.

.png?width=302&name=Hines%20V3%20(2).png)